FREE consultations by telephone or by internet video conferencing are now available.

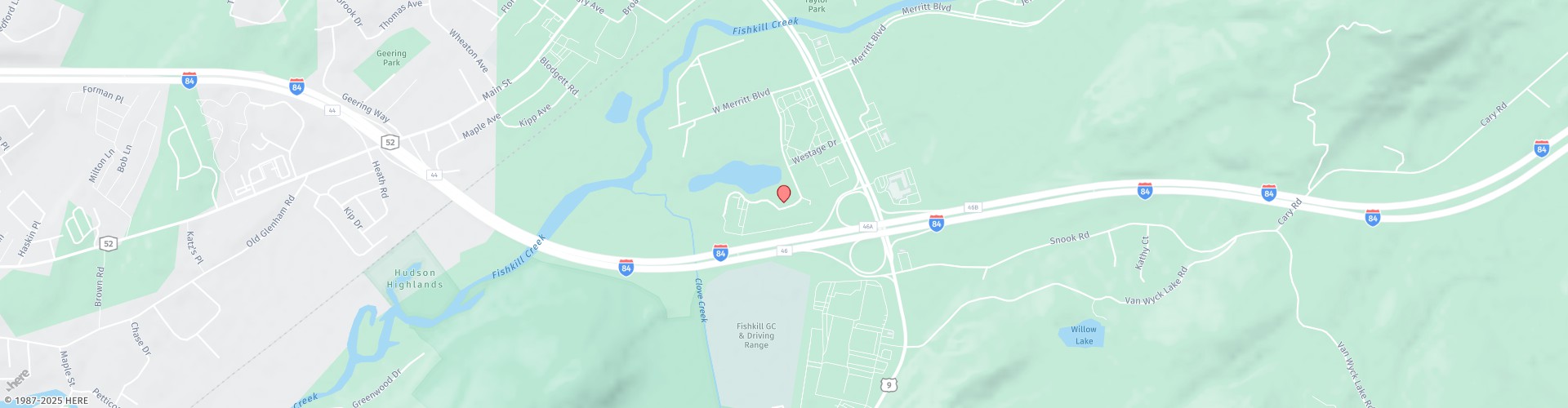

Fishkill Injury Attorney Serving Wappingers Falls, Beacon, Lagrangeville and Nearby Areas of Hudson Valley

Posted: November 6, 2019

No one likes paying taxes, whether they be income taxes, sales taxes, estate taxes, or real estate taxes. Yet, many Americans don’t pay taxes. Obviously, failing to pay taxes is a very risky thing to do because, if you get caught, you may end up serving jail time in addition to having to pay the taxes with penalties and interest on top.

When it comes to your personal injury case, failing to pay taxes can have a devastating affect that people rarely think about until they’ve been injured. Let’s say you have a “cash business” and make a substantial sum of money that is not reported to the tax authorities. What happens when you get injured due to someone’s negligence? One of the elements of damage that can be claimed in a personal injury lawsuit is loss of income. However, if you have not reported your income, you will not be able to claim the lost income in the lawsuit without placing yourself in jeopardy with the tax authorities and local and federal prosecutors.

Another way that failing to pay taxes can impact your personal injury case is that if it comes out that you didn’t pay your taxes, it will likely impact your credibility as a witness. The most important witness in a personal injury case is the injured party. At the time of trial, the judge will instruct the jury that If a witness has been untruthful, they can choose to disregard part or all of the testimony by that witness. This can cause you to lose your case entirely or receive a substantially reduced verdict because the jury may not believe your testimony regarding your pain and suffering.

So, is there anything that can be done to salvage the situation if you have a personal injury and did not pay your taxes? If you’re lucky, and the failure to pay your taxes was only in the current year for which tax returns have not yet been filed, you can file your returns and report all of your income with the possibility of just having to pay penalties for not having taxes withheld from your pay check or not paying quarterly estimated taxes on time. If tax returns were not filed on time, or you failed to accurately report your income in the tax returns you did file, you can and should file amended returns and pay the taxes, penalties and interest that will likely be due.

I’m not a tax lawyer and I highly recommend that you consult one if you have not properly reported your income.